Insights and Observations

Economic, Public Policy, and Fed Developments

- The markets expected Powell’s Jackson Hole speech to represent a major policy shift, akin to 2022’s “steely resolve to beat inflation.” They were disappointed; Powell’s remarks were neutral enough that both hawks and doves came away believing he was in their camp. We would argue that this actually is a major shift, that the Fed believes rates are restrictive enough to shift to a data dependent response, which is a sharp departure from last year’s iron-clad commitment. Powell indicated he believes more work needs to be done, but that the risks had shifted to growing economic strength more than current inflation readings. We agree on both counts.

- Even after August’s Q2 downward GDP revisions, the US economy has proved to be unexpectedly resilient in the face of the Fed’s interest rate campaign. The second revision showed still-strong 2.1% growth, where a now-familiar combination of tepid business investment and stronger consumer spending netted out to a -0.3% revision from the first. If anything, growth is now accelerating; the Atlanta Fed’s GDPNow tracker currently reads an eye-popping +5.6%, two-thirds of the way through the quarter.

- August’s jobs report was, on the surface, good news for the Fed. It showed a slight upwards beat but with large prior downward revisions, and a surprise jump in the unemployment rate from 3.6% to 3.8%. Below the headlines were two bigger stories, one encouraging, one less so. First, the unemployment rate rose because the workforce increased by 700,000, to 62.8%. This is the highest reading since February 2020 and finally returned workforce participation to pre-pandemic levels. More jobseekers means less upwards wage pressure and a higher potential output for the economy. Both developments are welcome.

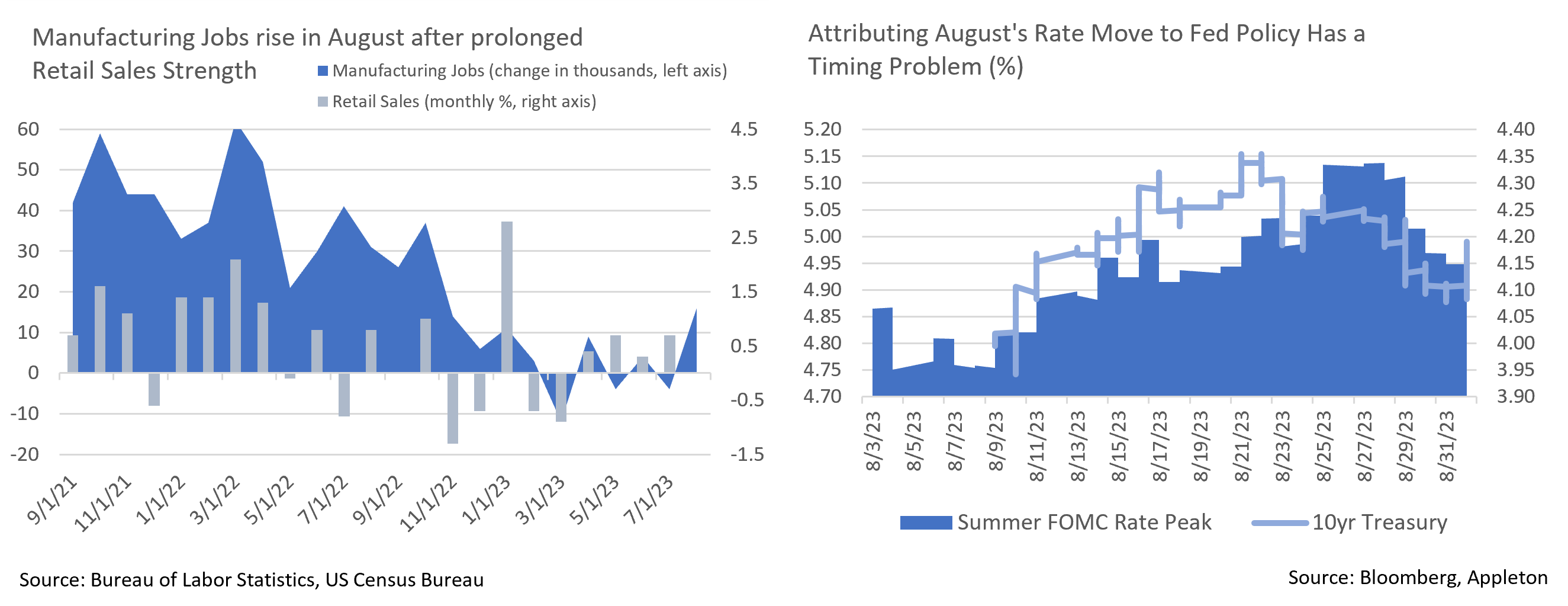

- However, manufacturing employment also jumped an unexpected 16,000 over the month. After several months of strong (goods-heavy) retail spending reports, we had been looking for an uptick in the goods-producing side of the economy. This rise plus an upwards surprise in the August ISM manufacturing report looks like the beginnings of one. With the Fed trying to cool the economy, a re-acceleration in the goods-producing sectors isn’t welcome and could force their hands to hike rates later this year and in early 2024.

- With all eyes now turning to the September FOMC meeting, markets have concluded the Fed will hold rates steady for one additional month, with a November hike possible but not assured. Absent a strong CPI surprise, we agree on September; while we could see the Fed hiking either to send a strong signal that they will not telegraph future moves, or to get ahead of a second wave of inflation from an uptick in economic activity, neither scenario is likely. November may be another story, however, with commodity prices having bottomed and now rising, and with what should be a very strong Q3 GDP report.

- Long term Treasury yields grabbed investor attention in August. After a quiet June and July, the 10Yr broke over 4% and briefly hit the 4.30s, before settling into the 4.10-4.20% range. Commentators at the time attributed this to a hawkish Fed response to strong growth; this explanation feels incomplete, as the peak in yields came a week before the peak in market expectations for the summer of 2024 Fed Funds rate. An upwards shift in the Bank of Japan’s long term rate guidance may instead be the culprit. In any event, there has been strong investor demand above 4.30%, representing levels that have not been available to investors since 2007.

From the Trading Desk

Municipal Markets

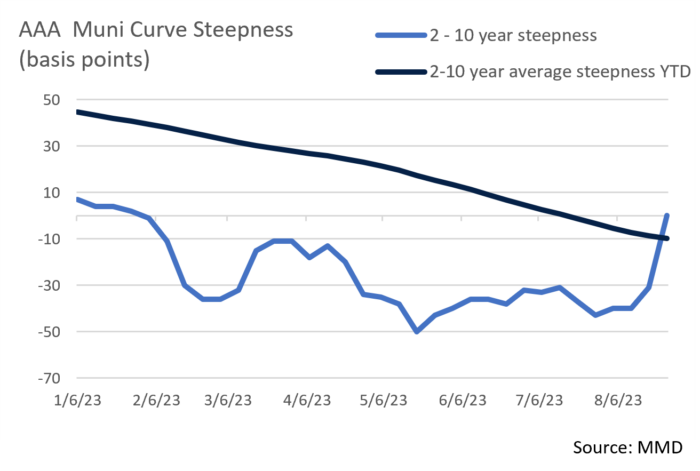

- Despite the Treasury yield curve experiencing numerous curve inversions since the 1980’s, the municipal curve had always been upward sloping until December 2022. At that time, the 2 to 10-year curve inverted, with a max spread differential of -48bps occurring in May. As August drew to a close, 2-10s remain inverted at -25bps, somewhat flatter than the -42bps differential seen at the beginning of the month.

- The inversion pivot point on the curve where yields begin to increase and incremental returns can be captured has recently shortened, creating value opportunities in the 7 to 10-year range that have not been available in recent months.

- The September 30-day new issue calendar is expected to be about $26.8 billion, with $9.1 billion anticipated this week. The new issuance docket is currently being led by the State of California ($2.6 billion) and the Port Authority of NY & NJ ($1 billion), two issuers of considerable interest to Appleton.

- August’s tax-exempt issuance of $35 billion was 15% above August 2022, although YTD gross issuance of $240 billion remains 13% below the same period of 2022. Tax exempt supply of $214 billion has come in 6% lower on a YTD basis vs. 2022 but is in line with the 5-year average. Primary market inventory is still tight and new offerings often remain oversubscribed.

- September not only brings with it the onset of fall, but also a period of market technical factors that we believe will be more supportive than usual. September marks the end of a high summer period of reinvested coupon payments and typically introduces greater issuance. However, in the current rate environment, issuers have been discouraged from coming to the market and this diminished supply coupled with sustained demand at attractive nominal yield levels may lead to favorable technicals.

Corporate Bond Markets

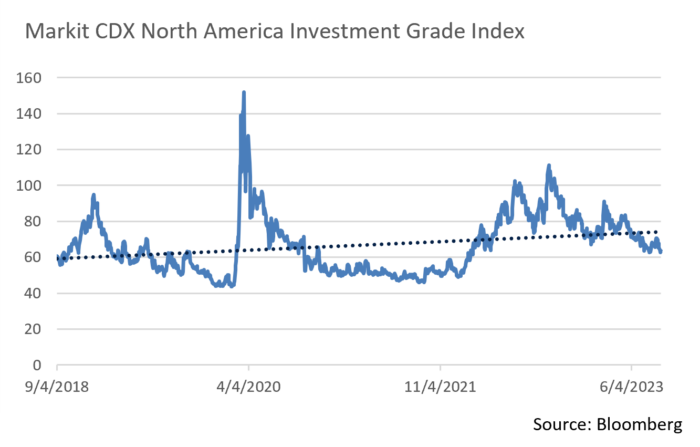

- The High-Grade credit markets, as measured by the Markit CDX index, have exhibited sustained strength since mid-May with spreads hitting a YTD low of 63 at the end of July. That path veered moderately off course in August as the index briefly touched 71 only to return to YTD lows. The last time the index touched these lows was back in early February of 2022 just before the Federal Reserve began its current tightening cycle.

- We feel the market is signaling that investors believe the Fed may be close to the tail end of its rate hike cycle, as the cost of protection against a credit default has fallen. Forthcoming economic data will likely create further volatility, although demand should keep spreads in check.

- Credit spreads have largely been stable over the past couple of months. The OAS on the Bloomberg Barclays US Corporate Index began August by touching a YTD low of 112bps before retracing to 118bps to close the month. The average OAS over the past 5 years is 123bps and we expect credit spreads to remain range bound over the near term. This view is predicated on sustained primary and secondary market appetite, an end to the rate hike cycle, and economic stability. Even though a breakout in spreads is unlikely, we favor quality given the persistence of volatility and the tendency of higher rated credits to better withstand market swings.

- Last month’s $65 billion in new High-Grade bond offerings fell short of expectations as Treasury volatility kept many issuers on the sidelines. A more stable rate environment, combined with a positive credit tone, should bolster the new issue market going forward with an estimated $120 billion expected in September. Much of this new supply should hit right after the Labor Day weekend and well ahead of the September 20th Fed meeting. We will be watching credit appetite closely but expect more than ample investor demand.

Public Sector Watch

Credit Comments

Maui Wildfire: Credit Implication

We begin this commentary by expressing our deepest condolences to all of those who have been impacted by this destructive event. As always, humanitarian concerns are foremost in our minds, and discussion of municipal credit considerations does not ignore the tragic loss of life and extensive property damage.

- The County of Maui experienced the deadliest American wildfire in more than 100 years in mid-August, a disaster that claimed at least 115 lives with another 388 missing at last report. The wildfire was also responsible for devastating property damage, primarily in the Town of Lahaina on Maui’s west coast. Moody’s Risk Management Solutions estimates that total economic losses could reach $4 – 6 billion.

- In Hawaii, the State and Counties are responsible for most governmental services and are the primary issuers of municipal debt. With respect to this wildfire, Maui County is the municipal issuer most acutely impacted. Based on their most recent audited financials, (6/30/22), the County had $325 million of General Obligation (“GO”) debt outstanding.

- Despite the magnitude of these events, we expect the wildfire to have only a minimal near-term impact on Maui County’s credit profile. Appleton continues to approve Maui County’s GO Bonds for purchase and holds the County’s creditworthiness in high regard. Strengths include a large and diverse tax base, a healthy economy, high resident income levels, ample reserves and liquidity, and prudent management of long-term debt.

- While Maui County may face some short-term liquidity needs, federal emergency aid, state grants, and private insurance proceeds will eventually cover costs associated with clean up, operational disruptions, and rebuilding. Maui County maintains at least $619 million of unrestricted cash, a sizeable liquidity cushion that represents 80% of annual revenue.

- The Town of Lahaina also only represents a small portion of Maui’s footprint and taxbase, covering about 4 to 7% of square mileage and assessed value.

- Tourism, Maui’s largest industry, is experiencing short-term disruption although we expect visitor counts to rebound to pre-wildfire trends fairly quickly.

- Other credits such as the State of Hawaii and essential transportation infrastructure, should also incur only modest implications and require minimal financial adjustments.

Hawaiian Electric Facing Scrutiny

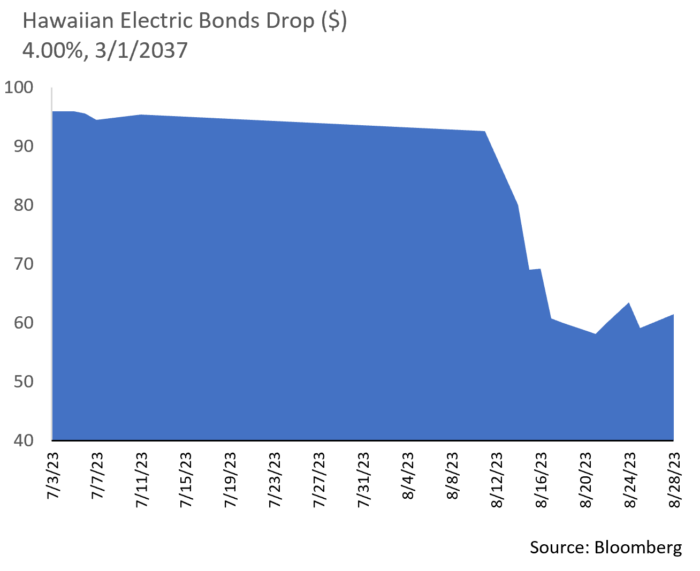

- Hawaiian Electric, a for-profit electric utility that serves almost 95% of the State, faces much more significant fiscal impact in our view. While it is early in the process and investigations are ongoing, several class action lawsuits have claimed that Hawaiian Electric’s infrastructure may have been responsible for starting the fire and that the utility may not have acted prudently in shutting down power as high winds approached the island.

- The Utility’s equity and debt prices have plummeted in response as the market tries to quantify the magnitude of financial repercussions, and S&P, Moody’s and Fitch have downgraded the credit to below investment grade.

- Hawaiian Electric has approximately $500 million of municipal debt outstanding, a combination of taxable and tax-exempt obligations. We do not hold Hawaiian Electric debt in client accounts and have not previously approved this issuer for investment.

- Recent events in Maui have reinforced our emphasis on investing in essential governmental providers and the need for comprehensive credit analysis, including assessment of geographic and business exposure risks, among other factors. While predicting developments such as wildfires is near impossible, we have found that a preference for high-quality, large, well-established governmental issuers, coupled with maintaining prudent issuer and sector diversification, offers considerable portfolio stability.

Strategy Overview

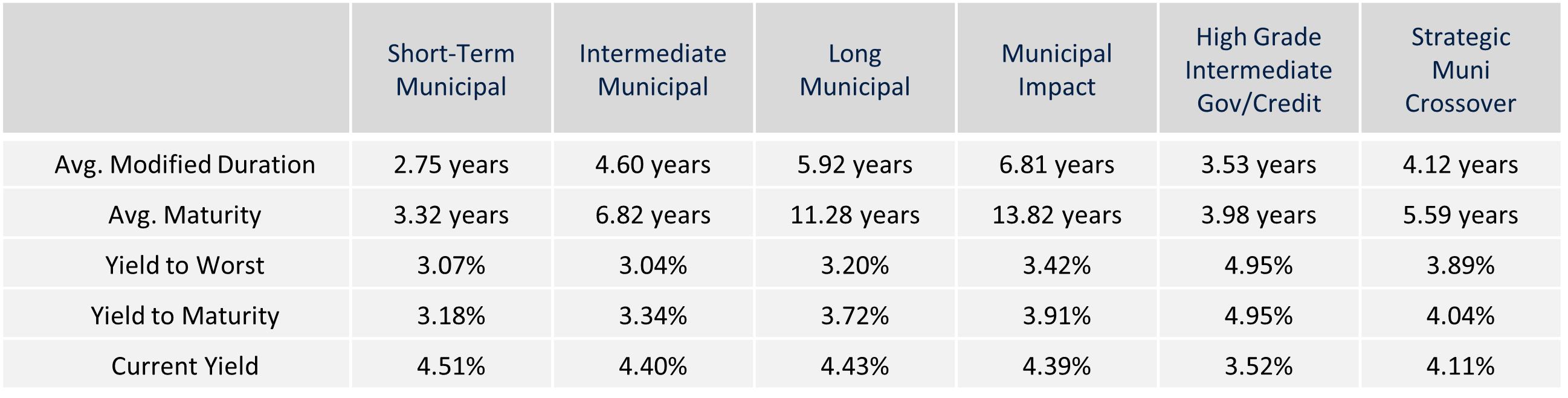

Composite Portfolio Positioning as of 8/31/2023

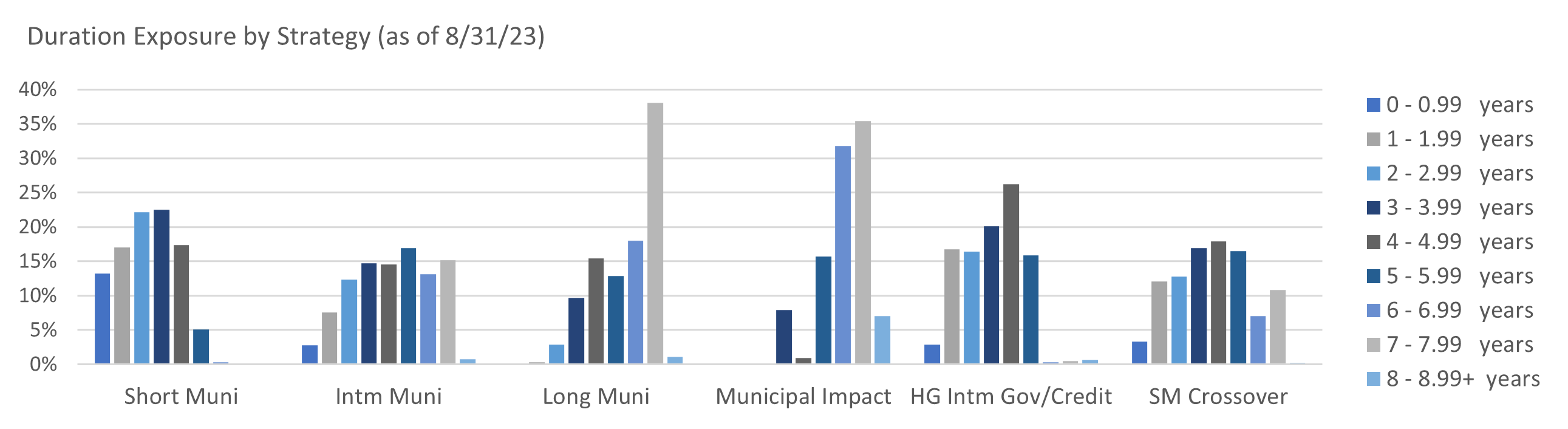

Duration Exposure as of 8/31/2023

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.